In the last two posts (Part 1 and Part 2), I outlined the central banking scam. I also revealed that in 1910, six wealthy men met in secret to bring the scam to the United States. The result was The Federal Reserve System (‘The Fed’), which continues to defraud Americans.

However, there is much more to the Federal Reserve and central banking than meets the eye. I contend in this article that the Fed enslaves Americans and allows for war and moral atrocities worldwide.

How does the Fed do this? Let’s unravel this mystery.

And of course, please subscribe if you enjoy my Substack.

Lead Us into Bondage

The situation of modern man is one of slavery. He is no longer compensated according to his productivity, and is forced to pay an increasingly larger share of his salary in taxes. His meagre income is further reduced by inflation, which destroys his purchasing power, and so he struggles to feed his family. And he is made to endure this sorry state with a smile.

Not all of this is the fault of central banks. As more immigrants and women entered the workforce in the 1970s, wages declined. The rise of globalization meant that businesses could ship manufacturing jobs overseas — to countries with lower pay and worse safety standards. The U.S. government became more blatantly corrupt. However, central banking played a huge role in how this unfolded.

There are two ways in which central banking enslaves citizens:

Devaluing the currency through inflation.

Bailing out big companies, leaving everyone else to pay for it.

There is also another way in which central banks, and in particular the Fed, enslaves others, and that is through funding war.

All That Glitters

Before the Federal Reserve, most Western countries operated under the classical gold standard, which I discussed in Part One. The gold standard limited the money supply by ensuring that pure gold backed every dollar in circulation. In the United States, this meant that $20.67 could always be traded for 1 ounce of solid gold.

The gold standard did not work perfectly, but it ensured that inflation was zero. If the government and private banks could not find more gold, then they could not issue more currency. Inflation occurs when more money chases fewer goods and services. With a gold standard, this was rarely a problem.

The gold standard also encouraged international trade. Because each country fixed its currency to a set amount of gold, this meant that exchange rates remained stable. For example, since the U.S. dollar was worth 0.053 ounces of gold, and the British pound sterling was fixed at 0.258 ounces of gold, the exchange rate was always around 1 British pound for 4.867 U.S. dollars (that is, 0.258 divided by 0.053). This ensured that large foreign exchange fluctuations would not occur.

Once the Federal Reserve came into being, the world gradually abandoned sound monetary principles. The onset of WWI saw the suspension of the international gold standard, as war-hungry nations hastened to print money to spend on U-boats, troops, and armored vehicles. In the United States, inflation hit double-digits, while in the Austro-Hungarian Empire it reached 100 percent.

After the war, the Fed and other central banks met in 1922 to patch together a new gold standard, but there was no discipline to this system. The Fed under its governor, Benjamin Strong, printed dollars liberally — sending stocks flying to the moon. The eventual crash in assets like stocks and real estate triggered The Great Depression, the worst economic catastrophe in U.S. history.

Some claim that the Fed engineered the Great Depression so they could blame its severity on the gold standard, and thus build support for a fiat money system. Whatever the truth, the fact is that throughout the 1920s the Fed printed money, which people took and invested in bonds, stocks, and real estate; as the prices of those assets rose, Americans thought they were financial geniuses. When reality hit, and their wealth was wiped out, job losses and bankruptcies ensued.

The gold standard was an easy scapegoat. In 1934, newly-elected President Franklin D. Roosevelt signed The Gold Reserve Act into law, ending the gold standard. Soon afterwards, the U.S. dollar plummeted 11.5% against European gold-based currencies, and fears of inflation arose.

Although the U.S. tried a new gold standard in 1945 called the Bretton-Woods System, it was an unmitigated disaster. The Federal Reserve continued to print money, and French President Charles de Gaulle even called the U.S.’s bluff. In 1971, the U.S. went off the gold standard completely, and inflation continued to skyrocket.

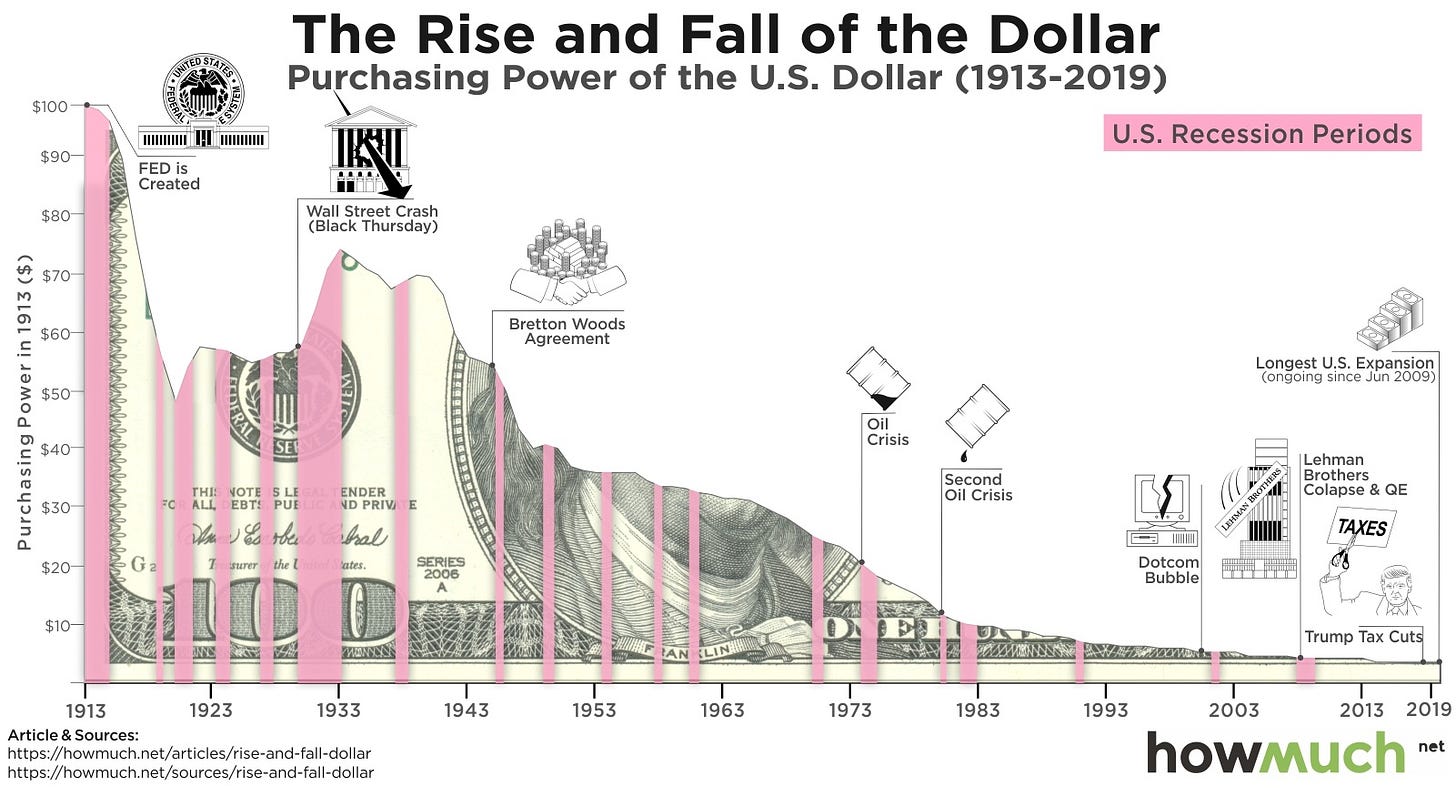

The Hidden Tax

A gold standard does not require a central bank. Despite (or perhaps because) of this, financial crises and recessions under the classical gold standard were mild. However, once the Fed entered the picture, things changed dramatically; the Fed oversaw the Crash of 1921, The Great Depression, recessions in the 1950s and 1960s, the 1970s stagflation, Black Monday in 1987, and the 2008 financial crisis. Furthermore, the Fed has presided over significant inflation, which has eroded the average American’s purchasing power.

Since the Fed was born, the U.S. dollar has lost 92% of its purchasing power, and wages have not risen to keep up with this. In 1960, the typical American house sold for $11,900, while the average salary was $5,600. In other words, an average 1960s man could pay off his mortgage in 5 to 6 years. Today, a typical house is worth $240,000. With the average American’s salary of $68,000, this means a house today is 3.5 times the typical salary. It now takes far longer to pay off a home.

Of course, you do not have to look far to see that prices everywhere are going up, while your wage stagnates.

This in itself is bad enough, but what makes it worse is that inflation is a hidden tax. The government can always print money to fund wars, social programs, and healthcare, passing the cost to its citizens via inflation. This especially hurts poorer Americans, who lack assets like houses and stocks they can use to hedge against rising prices. In other words, inflation transfers resources from citizens to the government.

To see how this works, imagine that Congress gives you the sole power to create U.S. dollars. If you are cunning, then you would print $1 trillion, use the money to immediately purchase real estate, stocks, commodities, etc., and then wait for that $1 trillion to filter through the economy. Once it does so after several months, inflation occurs. However, at this point, you would be fine: you have enormous wealth in real assets, while those around you are struggling to keep pace with rising prices.

This is essentially what happens when the Fed makes money available for the government and commercial banks, allowing the latter to get rich at the expense of average Americans.

If forcing you to work, pay your taxes, and buy increasingly pricier items just so that you can live — while fat cats get richer — is not slavery, then I do not know what is.

Bailing Out Banksters

As I mentioned in my prior post, the Fed shifts banks’ losses onto taxpayers, while allowing bankers to pocket their profits. This encourages banks to take on larger and riskier loans. Throughout its century-long history, the Fed has used its money-creation powers to reward banks that would have otherwise failed in a free market.

An example of this is the history of AMTRAK, the United States’s national train service. AMTRAK was formed in 1971 through the merger of 20 railway businesses including Penn Central, the nation’s largest railroad with over 96,000 employees and billions in assets.

In 1970, Penn Central filed for bankruptcy, unable to pay off its loans. The twist to this story is that Penn Central owed money to the same banks that owned it.

Officers from Wall Street firms like Chase Manhattan, Morgan Guaranty, and First National were on Penn Central’s board of governors. Using the railroad company as a cash cow, these banks had lent it money to pay dividends to shareholders — such as themselves. Thus, Penn Central’s banker-directors earned interest on their loans to the company, while also receiving dividend payments from overpriced stocks they owned. There is also evidence, based on a 1972 Congressional investigation, that the bankers used Penn Central loans to finance personal expenses (yachts, houses, luxury trips, etc.).

Under a free market, such behavior could only lead to bankruptcy and the ruin of its directors. However, the United States’s banking system is anything but free.

Worried that a collapse of Penn Central would wound Wall Street, the Chairman of the Federal Reserve, Arthur Burns, arranged an indirect loan for Penn Central. However, Burns wanted U.S. taxpayers to back the loan, and so Congress passed the Emergency Rail Services Act in 1970, authorizing up to $125 million in loan guarantees. Wall Street was saved, at the U.S. taxpayer's expense.

Ultimately, this did not solve the problem, and Penn Central was swallowed up into AMTRAK, a company which has always operated at a loss. Congress has bailed out AMTRAK to the tune of over $100 billion since 1971. American taxpayers are picking up the tab for a company that should have failed under normal conditions.

And none of this would have been possible without the Fed.

Since the Fed’s creation in 1913, several bailouts have occurred. More recently, the Fed pumped trillions of dollars into Wall Street to bail out banks in 2019.

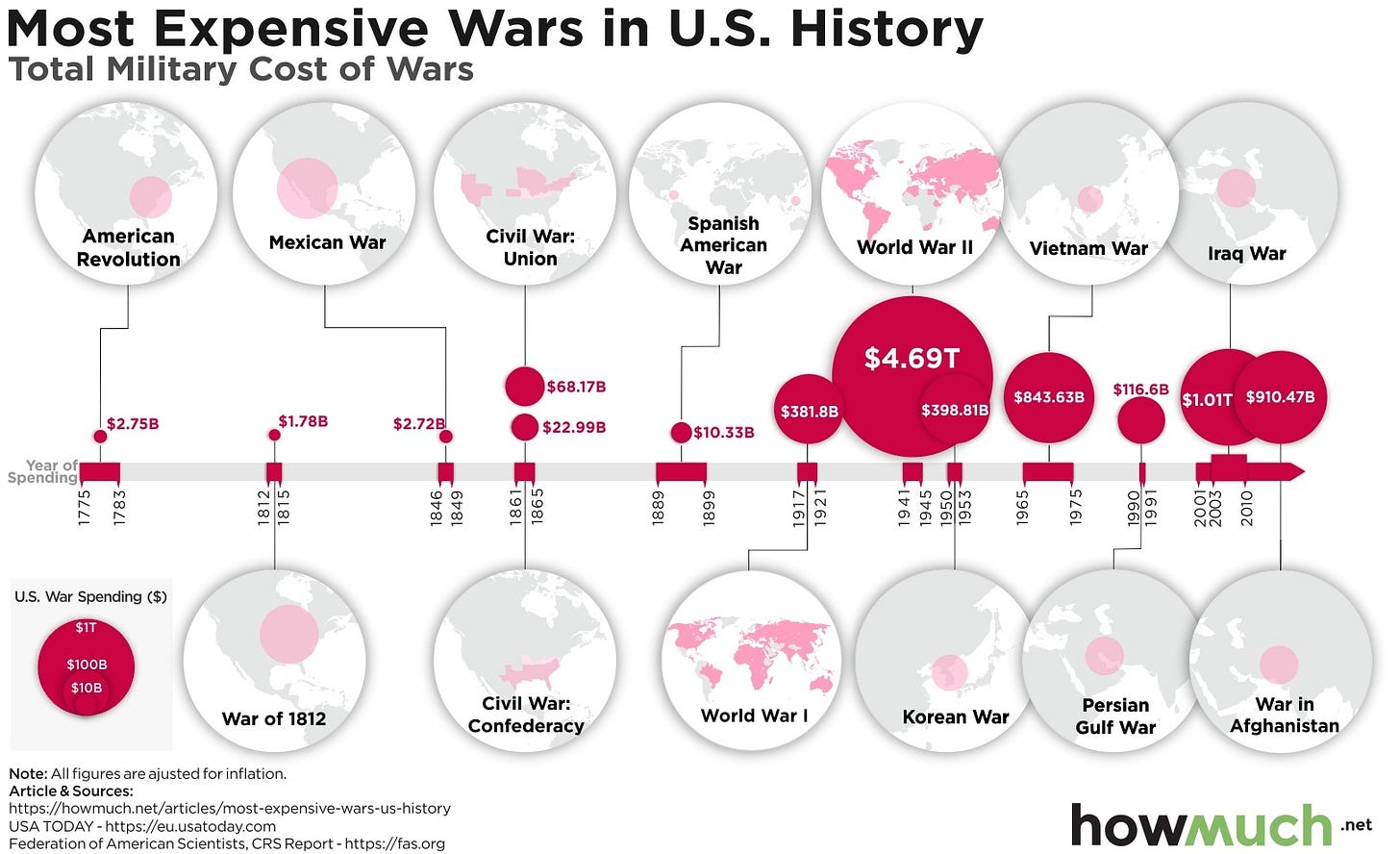

Warmongers

It should come as no surprise that the Fed makes money available for the U.S. government to fight wars. Since 1913, the United States has fought in several useless and foolish conflicts: WWI, Korea, Vietnam, Afghanistan, Iraq, Libya, etc. This benefits hawkish politicians and arms manufacturers, but confers no discernible boon to the majority of Americans.

Until the 20th Century, most countries used the gold standard and had no central banking, thus ensuring that money could not be easily printed to fund war. From the 16th to 19th centuries, conflict-related deaths were between 0.3% and 1.7% of the world population. In the 20th Century, with the advent of central banking and fiat currencies, conflict-related deaths ballooned to 4.35% of the global population, a dramatic rise driven by cheap money and bloodthirsty statesmen.

Granted, military technology has improved and become more lethal in the 20th Century, especially with new weapons like nuclear bombs, tanks, and missiles. However, purchasing such equipment itself requires a lot of money, which the Fed makes available to The U.S. Treasury.

Furthermore, American military might props up the U.S. dollar, ensuring that it is used as a medium of exchange in international trade. One of the reasons the U.S. controls military bases worldwide is an implicit threat: if you do not use the U.S. dollar to settle global payments, then we will invade you. Indeed, there is well-founded speculation that President Obama invaded Libya because its leader, Muamar Gaddafi, wanted a gold standard, which would have freed Libya from U.S. dollar hegemony.

The U.S. can’t have random Middle Eastern countries telling it what to do!

Conclusions

In this series of Substack articles, I have merely scratched the surface of the behemoth that is the Federal Reserve. I recommend, therefore, that the curious reader pick up The Creature from Jekyll Island by G. Edward Griffin, which goes into further detail on the evil that is the Fed.

I also recommend this 30-minute documentary on central banking, which will give you more value than an introductory macroeconomics course. Currently, it has over 9 million views. Hopefully YouTube won’t take it down.

And, of course, if you enjoy my articles then please subscribe.