The Dark Origins of The Federal Reserve (Part 2): The Secret Meeting

A creature spawned from usury, a horror most vile

'People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the publick, or in some contrivance to raise prices.’

-Adam Smith, 1776.

(This is part two of my Federal Reserve deep-dive. To read part one, click here.)

NOVEMBER 20, 1910 - Six men, clad in finely-tailored suits, board a train in New Jersey. They have their own private passenger car, exquisitely decorated: mahogany panels, leather armchairs, and a brass rack stocked with wine, beer, and spirits. Servants bring them gourmet food and fine cigars.

The six men have been instructed to use only first names. Their servants and porters have been thoroughly vetted. Nothing is left to chance.

They are heading to Georgia. Their cover story is that they’re going duck hunting. It is all a ruse.

Yet, these men are not spies or mafia gangsters. They are bankers and politicians.

Who were these men?

The six men en route to Georgia that day represented one-fourth of the world’s collective wealth. There is speculation that their bloodlines trace back to the so-called Dark Aristocracy of Europe, powerful families bred from occultic matchmaking and satanic rituals.

But that is just a crazy conspiracy theory. Lol.

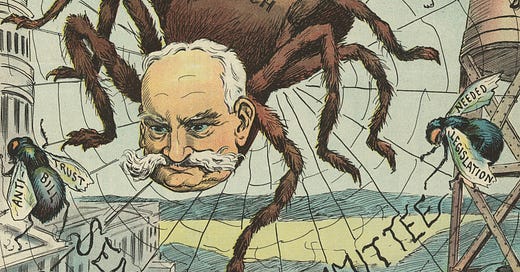

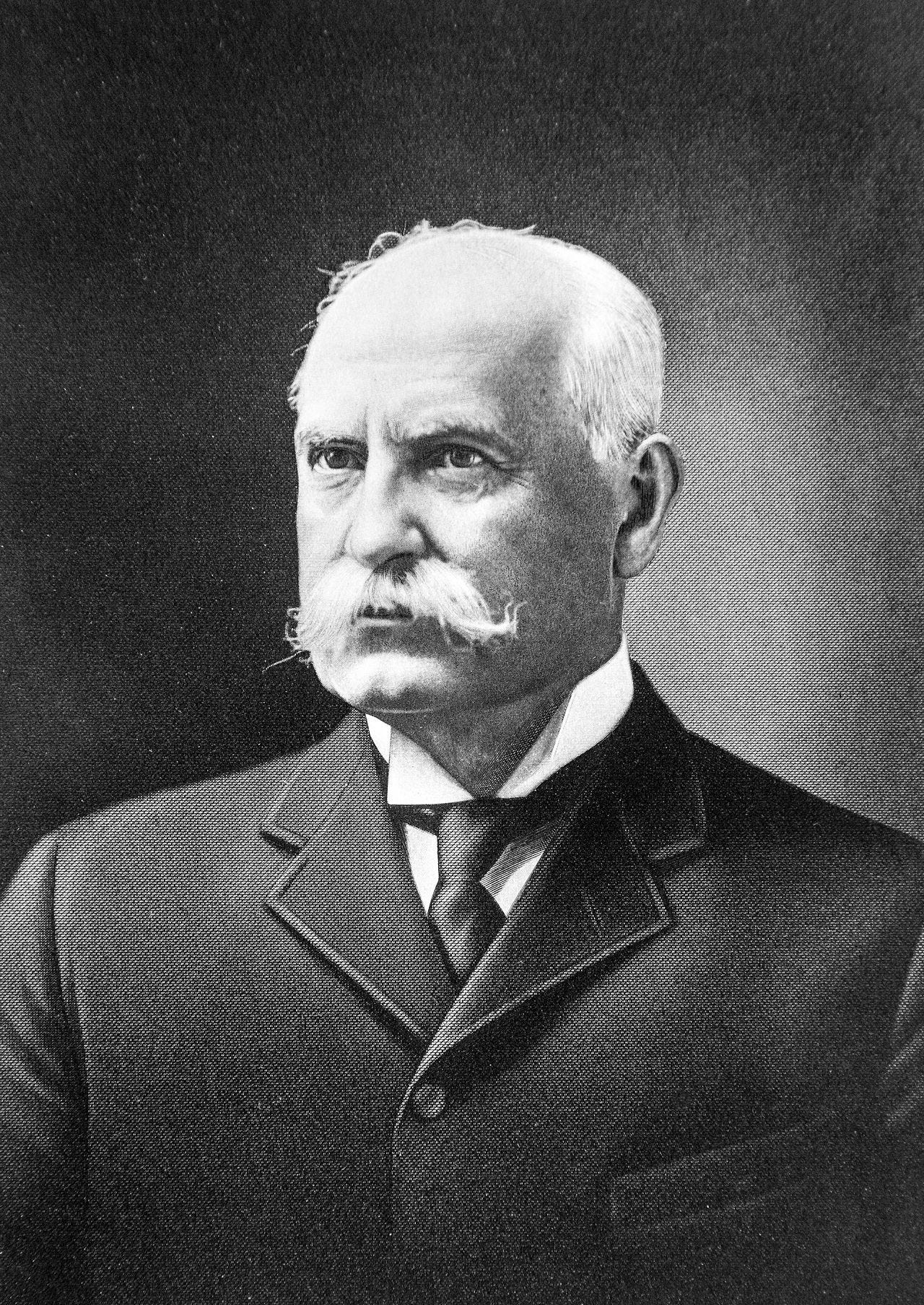

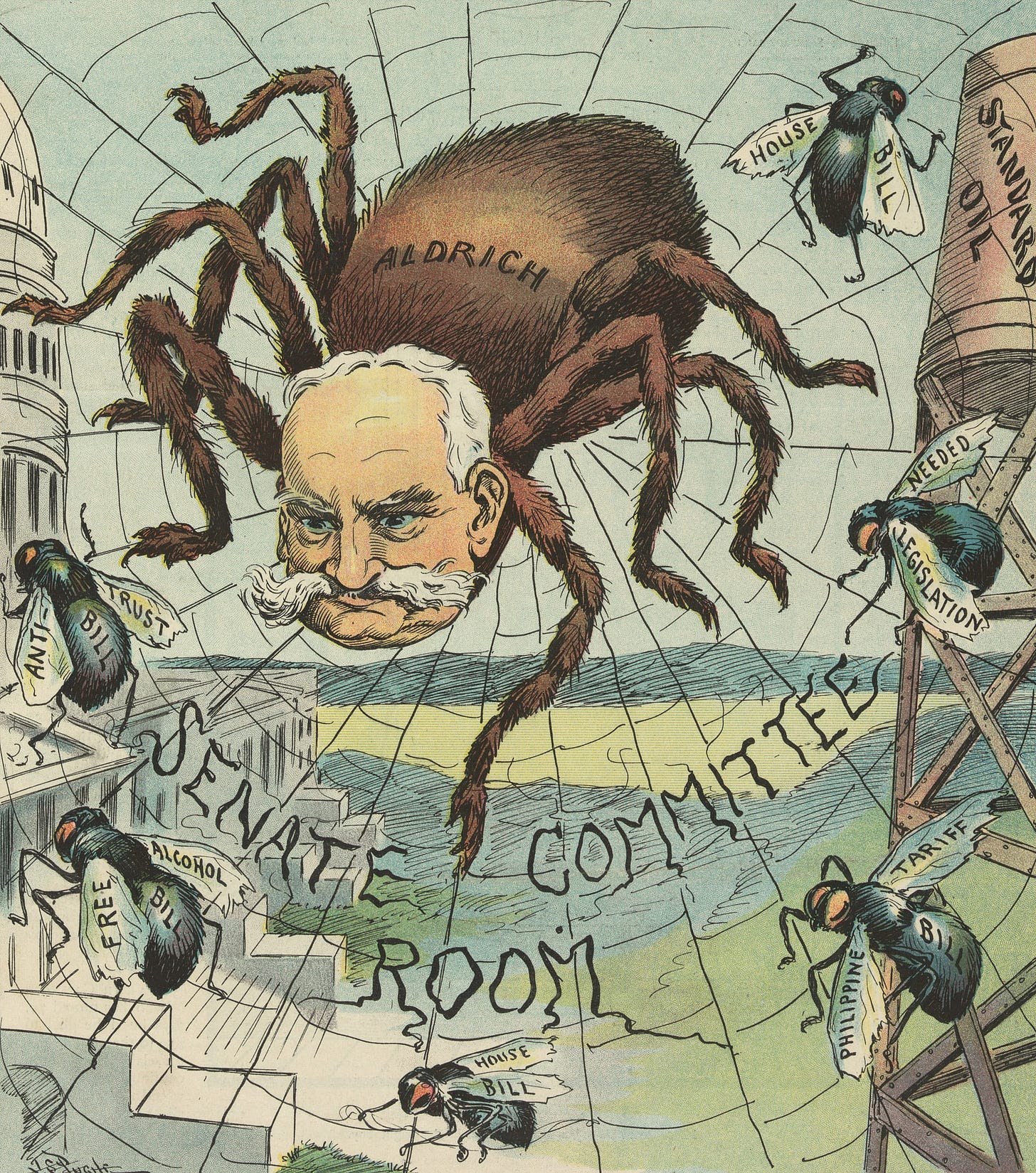

The first of these men was Nelson W. Aldrich, Republican Senate whip and Chairman of the National Monetary Commission. Aldrich’s ancestors include Roger Williams, who founded Rhode Island in the 17th Century. Aldrich was also a business associate of J.P. Morgan, a wealthy American banker, and father-in-law to John D. Rockefeller, Jr., heir to a large oil fortune.

Aldrich was wealthy himself. It was his private railroad car that these six men boarded.

As a powerful politician, Aldrich favored big business and big government, supporting measures like an income tax, tariffs, and central banking. This made him unpopular with the common man, but because of Rhode Island’s restrictive voting laws, which prevented those lacking property from the franchise, he kept getting re-elected.

The second man to board the train was Abraham Piatt Andrew, Assistant Secretary of the Treasury. Andrew was a former Harvard professor of economics, selected to serve on Aldrich’s National Monetary Commission. He was likely gay, and it is possible that he was blackmailed to go along with the bankers’ scheming. Homosexuality at the time was illegal.

Frank A. Vanderlip, President of the National City Bank of New York (now called Citibank), the most powerful U.S. bank, was also on the train to Georgia.

Vanderlip was well-connected, having served in the White House until 1901 as Assistant Secretary of the Treasury. He also had a background in journalism, working as financial editor of The Chicago Tribune from 1892 to 1897. He had many contacts in politics and business including William Rockefeller, a founder of Standard Oil, North America’s biggest oil producer. Vanderlip was also well acquainted with Kuhn, Loeb, & Company.

Kuhn, Loeb, & Co. was headed by Paul M. Warburg, the fourth man to board the train. He was a close associate of the infamous Rothschild banking dynasty. Paul’s brother Max was head of the Warburg banking conglomerate in Europe. The Warburgs are a prominent family with origins in Renaissance Italy.

I am posting Paul Warburg’s photograph here, so you can make unfounded assumptions about his character.

Here is a closeup.

Henry P. Davison, another member of the group, was a senior partner at J.P. Morgan & Company. After his involvement with the Jekyll Island group, Davison accepted a job as an executive at The Red Cross. Although it is well known as a humanitarian organization, The Red Cross has ties to intelligence services. It is a curious coincidence that Davison’s son Frederick later became the CIA’s director of personnel.

Finally, there was Benjamin Strong, head of J.P. Morgan’s Bankers Trust, a large Wall Street bank. Strong would later become the Federal Reserve’s first governor.

These six men were known as The Jekyll Island Group.

The Secret Location

After reaching Brunswick, Georgia, the six men set off for an island off the coast. Jekyll Island, which J.P. Morgan had purchased along with his business associates, was private land. It was here that the Jekyll Island Group met in secret to concoct their wicked scheme.

Ostensibly, they were travelling to hunt ducks and deer. Paul Warburg, who had never even held a firearm before, borrowed a shotgun from his friend to appear legitimate. When the local press asked the six men what they would be doing in Jekyll Island, ‘duck hunting’ seemed like a perfectly plausible answer.

But they were not there to hunt ducks…

The Problem is Competition

Whether he is selling shoelaces or insurance, a businessman faces a constant worry: competition. If his competitors are more efficient or innovative, then they can drive him out of business. Ideally, a businessman would like the power to set his own prices and production schedule, without having to worry about competitors underpricing him.

The same applies to banking.

The problem facing the Jekyll Island Group in 1910 was how to rein in competition. In the past ten years, the number of U.S. banks had doubled from under 10,000 to more than 20,000. Most of them were opening in the South and West, threatening established New York firms. Furthermore, they were offering competitive interest rates, thus reducing bank profits.

This market discipline also made businesses thriftier: businesses did not seek loans from banks as often. Instead, they funded investments from their own profits. Between 1900 and 1910, seventy percent of American corporate growth was funded by internal profits and equity, not debt.

Like businesses, the federal government, due to the gold standard, was becoming thrifty and did not need to rely as much on banks to borrow capital. The federal debt was dwindling. Thus, not only were banks’ profits diminishing, their political power was as well.

As G. Edward Griffin writes in The Creature from Jekyll Island,

What the bankers wanted — and what many businessmen also wanted — was to intervene in the free market and tip the balance of interest rates downward, to favor debt over thrift. To accomplish this, the money supply simply had to be disconnected from gold and made more plentiful or, as they described it, more elastic.

A bank’s business is loans, and the more loans it can offer, the more interest it can collect. This is how bankers make profits. The danger is when the bank becomes too risk-loving, providing loans to borrowers who cannot repay. Furthermore, banks which fail to hold adequate reserves risk a bank run. For the men at Jekyll Island, there had to be a way to bail out such foolhardy banks, even if doing so would hurt the public.

Enter the Federal Reserve system.

A Shameless Solution

The Federal Reserve (‘The Fed’) is a cover for a legalized cartel, a group of insider banks which control the money supply and interest rates to benefit themselves. Despite its veneer of public service, The Fed is itself a private bank with shareholders, who are entitled to a 6 percent share of the bank’s profits. The list of these shareholders is a closely guarded secret, but many speculate that the families who created The Fed at Jekyll Island — the Warburgs, Kuhn & Loeb, The Rothschilds, The Morgans, and The Rockefellers — also own it.

Although it is called ‘The Reserve,’ The Fed has no reserves; Congress granted it the power to essentially print money out of thin air. Whenever a bank is failling, The Fed can ‘print money,’ providing the bank with adequate cash to pay its depositors and other creditors. This saves the bank, but also causes inflation: more money, more problems.

(The actual mechanism The Fed uses is more sinister than just ‘printing money,’ but that is a topic for another post.)

Of course, the Fed has allowed banks to fail historically, but only when those banks are not insiders. An example of this is Lehman Brothers, a New York investment bank which at its peak had a market value of $46 billion. During the 2008 financial crisis, The Fed allowed Lehman to fail, while bailing out other irresponsible banks like Goldman Sachs.

Goldman Sachs’s ex-CEO at that time was also the U.S. Treasury Secretary, Hank Paulson, who worked closely with Fed Chairman Ben Bernanke to orchestrate a radical bailout of the U.S. banking sector. Of course, this meant that Wall Street was rescued at the expense of the typical U.S. citizen, who suffered through the resulting recession the banks had created.

To give you an analogy, imagine The Fed as an indulgent parent, and the banks as spoiled teenaged children. The children often get drunk, gamble away their money, and violently assault others. However, the kids’ mother, through her political connections and vast wealth, always bails the teenagers out of trouble — thus incentivizing the teens to continue with their bad behavior. To complete the analogy, picture the teenaged children planting a microchip into their mom's brain, which gives them complete control over their parent. This is the dynamic between The Fed and the private banking sector.

And this is the behemoth that was born on Jekyll Island in 1910, which came to maturity in 1913.

The Creature is Born

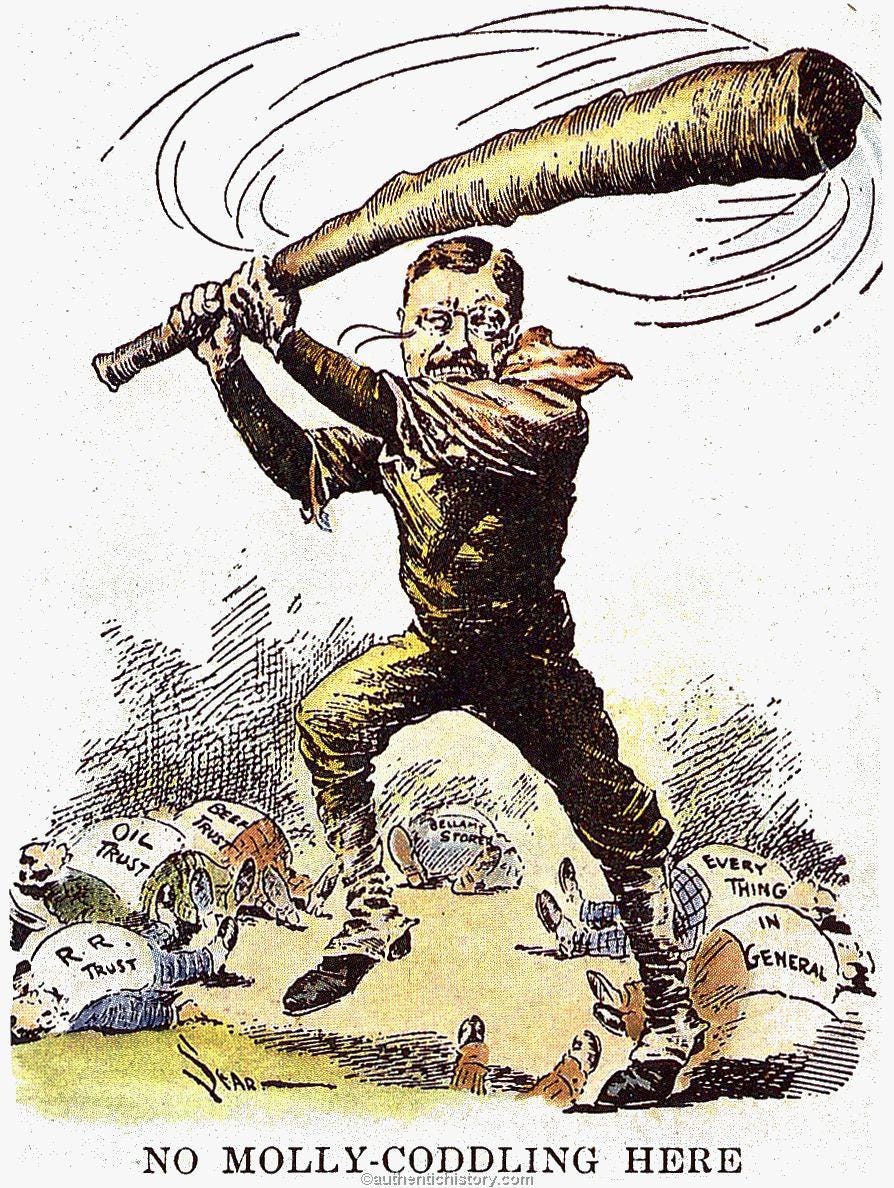

The Jekyll Island plotters knew what they wanted, but how to sell it to the public was another question. Americans hate cartels, and politics was not on the bankers’ side. The popular and outgoing U.S. President, Theodore Roosevelt, had sued forty-five companies for monopolizing their respective industries, and Roosevelt’s successor, William Howard Taft, continued this trust-busting fight against American corporations.

The strategy the Jekyll Island Group decided upon was to stoke Americans’ fear of losing their bank deposits. It worked. A financial crisis in 1907 had triggered several bank runs across the U.S., and many Americans had lost their savings. Their memories were fresh from The Panic of 1907. Therefore, when the six men on Jekyll Island drafted their plan for The Federal Reserve, they made it seem as though a central bank would protect the public.

This is a tried-and-true strategy. Evoke a recent horror, offer a vague solution that secretly benefits the elite, and then quickly pass it into law before anyone notices. In the process, crush the people’s freedoms.

(The War on Terror, anyone?)

Now that the Jekyll Island plan had been agreed upon, it had to be brought to Congress. Senator Aldrich’s reputation had been sullied by his dealings with bankers, and so it was decided that Carter Glass, a naive yet popular Congressman from Virginia, should introduce the bill. Through Colonel House, a prominent D.C. power-broker, Glass was convinced, and in August of 1913, The Federal Reserve Act was introduced in the House of Representatives.

On December 23, 1913, The Act was signed into law. The rest, as they say, is history.

Also, this is why people should know their history and economics.

Conclusions & Consequences

If you have reached this point, then you might think that this is all a kooky conspiracy theory. Yet, even mainstream NPC sources like National Public Radio and The Federal Reserve admit to the facts that I have laid out.

However, their interpretation of the facts is wrong. Apparently, according to NPCs, the Federal Reserve was created (in secret?) to help prevent financial crises and to maintain inflation at a low level.

Even if we accept this at face value, the Fed has failed by these metrics; the crashes of 1921 and 1929, The Great Depression, Black Monday in 1987, and the 2008 financial crisis occurred under the Fed’s watch, and were much worse than anything prior to The Fed’s inception. Furthermore, the Fed has failed to regulate inflation: What cost $1,000 in 1914 now costs almost $30,000, suggesting a loss in the U.S. dollar’s purchasing power. In other words, the Fed has overseen severe and frequent financial crises, and an inflation of 3,000 percent.

On this last point, G. Edward Griffin puts it succinctly when he writes, “that incredible loss in value was quietly transferred to the federal government in the form of hidden taxation, and the Federal Reserve System was the mechanism by which it was accomplished.” In other words, inflation is a tax. It transfers resources to those who control money, the government and banks, from those who do not, the general public. This is theft, pure and simple, and The Fed is the mechanism through which this operates through its control of monetary policy.

The Fed and central banking more broadly have also impoverished nations and fostered war and conflict. Arguably, the creation of The Fed also hastened the United States’s moral decline.

How, you may ask? Stay tuned for the next posted to find out.

If you enjoyed this, then please subscribe my Substack.