(I apologize for this late Substack article. I have just returned from a camping trip, and will now resume my regular posting schedule.)

Although I am an academic, I once left the Ivory Tower to gain real world experience. As part of my private sector job, I conversed with several finance professionals. And I realized that many of them subscribe to conspiracy theories.

By “conspiracy theory,” I do not mean Q-Anon or UFO nonsense. Wall Street bros are intelligent men who know their history and geopolitics. They subscribe to plausible conspiracy theories, such as 2020 U.S. election interference or The Anglo-American elite’s control.

I am not the first to notice this. Bloomberg columnist Justin Fox pointed out in 2009 that “Wall Street traders are among the most conspiracy-minded group of people on the planet.” Anyone who has worked on a trading desk knows this to be true.

There are three reasons for this.

Pattern Recognition. Wall Street traders use noisy data to make financial decisions. This is the same logic behind conspiracy-minded thought.

Insider Knowledge. When you understand how the financial system works, you start to question everything.

Clients. Some finance professionals do not actually believe in conspiracy theories. They just cater to clients who do, and act accordingly.

If you enjoy my content, please subscribe. If you really want to support me, then consider becoming a paid subscriber.

Professional Noticers

Successful investors take limited information, mould it into a cogent narrative, and then use that heuristic to buy or sell assets. The more a man does this, the more he becomes accustomed to lateral thinking — which leads into conspiracies.

In early 2020, as lockdowns rolled out, former BlackRock manager Edward Dowd foresaw jab mandates, digital IDs, and severe vaccine side effects. He expected the unvaccinated to be persecuted. Dowd, who used to manage a $14 billion fund, was ridiculed. His predictions were far-fetched at the time.

However, he was proven to be correct.

COVID is a good case study, since many finance bros did not get the clot-shot until their employers forced them to. Billionaire investor Eric Sprott directed his audience towards vaccine-skeptical experts like

. I even know a fund manager who avoided the jab mandate by quitting his corporate job and starting his own firm. It was not taboo to discuss the COVID psy-op on Wall Street.Compare that with professors, who rushed like zombies to get injected with mRNA sludge. In early 2021, I listened with disgust to a Zoom faculty meeting, as my colleagues gleefully recounted how they got vaccinated. Someone then brought up how ‘case numbers were rising,’ or some other such nonsense. I pointed out that the mathematical models used in public health are stupid (TL;DR they are primitive, undergrad-tier models of disease). I was quickly attacked for thinking outside-the-box.

Finance Makes You Red-Pilled

If you have seen The Wolf of Wall Street, then you may think that finance bros party hard. Cocaine, booze, and hookers are indeed common in New York, London, and other financial centers. I suspect that the reason for this, aside from excess money, is therapeutic: it is hard to cope with the reality behind the financial system.

The modern banking and financial system is built on lies. Every dollar is backed by debt. If there were no debt, the entire system would collapse. The monetary system is essentially a giant Ponzi scheme which defrauds the average man.

At some point, finance bros confront these facts. They are part of the system which, through inflation and taxes, is robbing hard-working normies, and transferring wealth to the ruling class. Unless the Wall Street man has religion, he turns to hookers and blow to cope.

Yet, once he has accepted these truths, he starts to question everything. If the financial system is simply a scheme to enrich the elite, then what about war? How about Big Pharma? Why is The World Economic Forum training political leaders? What does it all mean?

This sends the finance bro down a dark web of intricate conspiracy theories. Eventually, he starts reading about the Black Nobility of Europe and secret bloodlines and The Committee of 300.

(On a side note, the successful fund managers I have observed reject the mainstream economics they were taught in their MBA programs, and instead turn to Austrian approaches. Mainstream economics, aside from a few rudimentary tools, does not work in the real world.)

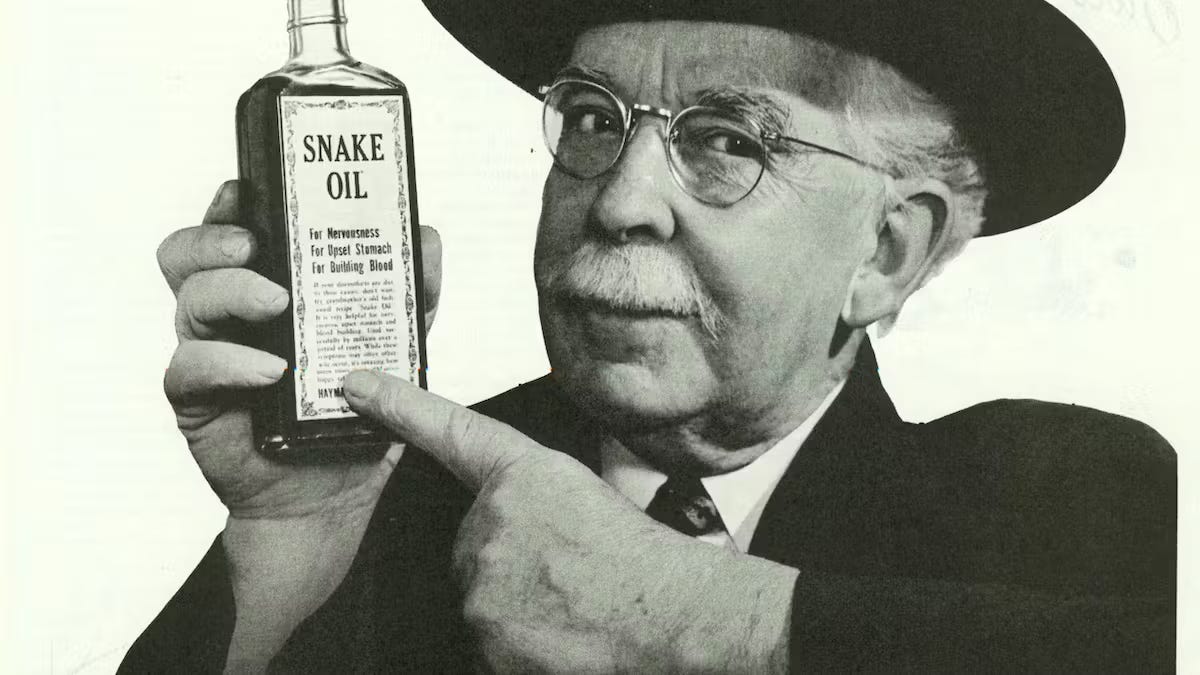

Dishonest Hucksters

A good salesman knows his customers. He gains their trust by mirroring their ideas and deepest desires. This includes salesmen who sell financial products; if their clients are conspiracy theorists, then the salesman will chat about conspiracies.

I have noticed this especially in the gold and Bitcoin arenas. Goldbugs and Bitcoin maxis are adversarial thinkers, and believe that the financial system is nearing imminent collapse. They are skeptical of everything the government does, which is why they invest in decentralized assets.

A clever salesman can exploit this to sell gold and Bitcoin. Find a goldbug, talk about Central Bank Digital Currencies, and explain why gold is the way to hedge against such tyranny. And voila! You have a client. It really is that simple.

This does not mean that the salesman necessarily rejects conspiracy theories — but whether he does or not makes no difference to the bottom line, profit. A dishonest man can make a living pitching incredible conspiracies to gullible retail investors.

Conclusion

In 2010, in the wake of The Great Financial Crisis, the movie Inside Job was released. Narrated by Matt Damon, it explains how Wall Street greed and regulatory capture led to the financial crisis. The film was a commercial success, and even won an Oscar for Best Documentary.

The movie is not wrong in its premise, but its cast of characters is curious. Among its “good guys” are globalists like George Soros, Christine Lagarde, Raghuram Rajan, and Dominique Strauss-Kahn. Why is Soros, the world’s most sinister fund manager, depicted like a saint in a film about the evils of finance-capitalism?

My suspicion is that Wall Street, despite its ill-gotten gains, poses a threat to the ruling class. Although its top echelons (like Soros) are elite globalists, the finance bros themselves are too wild. Fund managers and traders suspect what is going on at the top levels of power — and finance professionals control the purse strings.

In other words, because Wall Street professionals are conspiracy theorists who understand power, they pose a challenge to the ruling class. This could explain why the latter are in a rush to roll out Central Bank Digital Currencies. If the government controls your bank account, then what is the use of a bank? Weakening the financial merchant class is imperative.

It will be fascinating to see how this internecine conflict plays out in the shadows of power. I have my own predictions, but that is a topic for another Substack article.

Be sure to subscribe to keep up-to-date on my posts.

Interesting and thought-provoking. Tom Luongo theorizes Jerome Powell is wielding interest rate hikes at the Fed as a means to neutralize and destroy the vast off-shore eurodollar market and “defund” the Sorosian/Old European. Powell was in his life real trader, not an academic like Bernanke. And Jamie Dion is cheering him on.

Used to work in corporate finance (on the legal side). Can confirm.