There is only one rule in investing: do not lose money. Stocks are perhaps the quickest way to lose one’s savings, after bad crypto purchases. Unfortunately, people subscribe to too many fallacies about stock markets.

There are at least three myths about investing in stocks:

The stock market always goes up.

Well-managed funds can usually beat the market.

Stocks and bonds move in opposite directions.

As always, I caution you that this article is not investing advice. It is provided purely for educational purposes. Speak with a financial advisor about your own personal situation.

If you enjoy my content, then please subscribe. If you want to support me, consider becoming a paid subscriber.

Myth 1: The Stock Market Always Goes Up

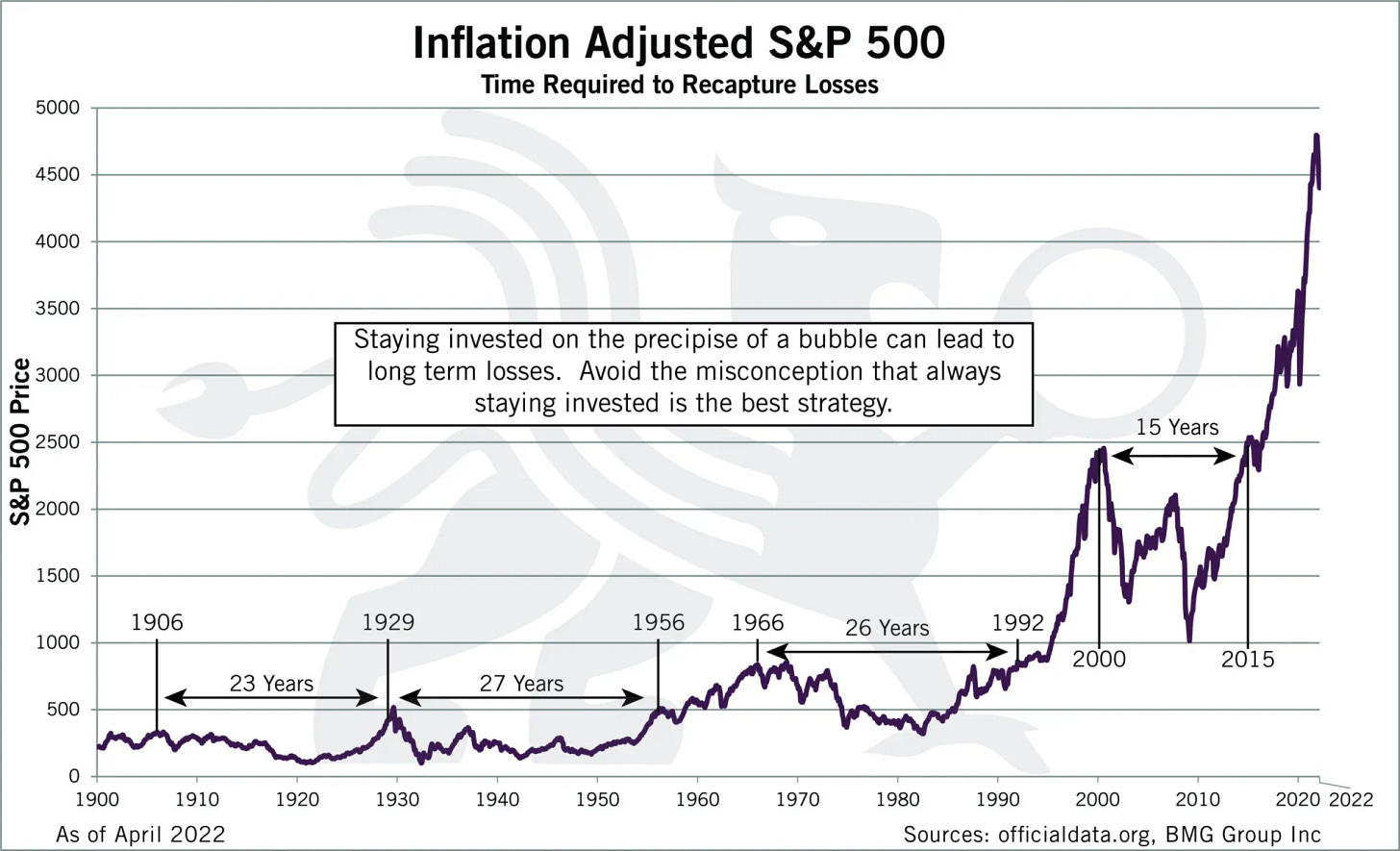

This claim is false, as the above chart shows. If you had invested your savings in U.S. equities in 1929, then you would lose your wealth — and it would take twenty-seven years for you to regain it. Furthermore, 1929 is not an anomaly; the chart shows multiple times over the past century in which money is lost in the stock market.

Many fund managers wrongly assume that stocks always rise over time. Yet if you intend to retire with a good monthly income, then a stock market crash could derail your plans. You could spend your retirement in a smoke-filled bingo hall as opposed to a posh golf course. The reason would be because you over-allocated to stocks, and got unlucky.

Of course, this should not matter as long as your money manager is a pro… right?

Myth 2: Well-Managed Funds Can Beat The Market

In one of the most influential finance books ever published, A Random Walk Down Wall Street, Burton Malkiel writes,

“A blindfolded monkey throwing darts at a newspaper's financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

This seems to be true. In 2010, a circus monkey beat 94 percent of Russian stock traders. Earlier, in 1999, a chimpanzee’s random stock picks outperformed the market.

Nobel Prize winning economist Eugene Fama and his colleague Ken French show that, on average, an active fund manager cannot beat the market. A manager can get lucky and earn impressive returns for a short while, but this is unlikely to last. There are rare managers who beat markets consistently, but they are hard to find.

Despite these facts, fund managers charge high fees to administer your money. If you put $100,000 into an actively-managed mutual fund, for example, you will pay 0.66 percent per year in management fees. Assuming the initial $100,000 grows at a modest 5 percent per year over thirty years, that means almost $75,000 in fees in that time. You’re paying for a product that does not beat the market.

This is why billionaire investor Warren Buffet recommends that most investors put their money in a fund which tracks the stock market. Buffett himself owns two index funds which track the S&P 500: VOO and SPY.

Granted, not all managed funds are bad, but most of them rely on a naive strategy: using bonds to hedge against stock market declines.

Myth 3: Stocks and Bonds Move in Opposite Directions

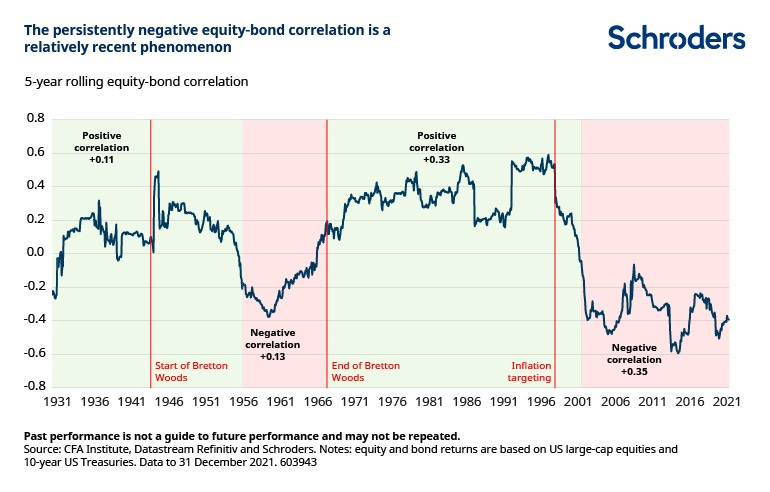

Many portfolios include both stocks and bonds, based on the assumption that they move in opposite directions — that is, that they’re negatively correlated. If the stock market crashes, then at least bonds will do well, the thinking goes. In other words, stocks and bonds hedge against each other.

The above chart disproves this notion. The negative link between stocks and bonds is a recent phenomenon. It is not true throughout history. In 2022, investing in both would lose money over the year. It is better to diversify beyond just two assets.

I once served on a pension committee, which invested in four assets: cash and cash equivalents, bonds, stocks, and real estate. That was it. A more sophisticated strategy would have included gold, commodities, and options. In my view, gold should comprise at least 5 percent of every pension fund.

Yet fellow committee members told me that gold lacks long-term stable returns. What nonsense! Gold protects against long-term inflation, and is a hedge against financial instability. Adding gold to a portfolio improves risk-adjusted returns.

The pension committee I served on is not going to make it.

Conclusion

It is important to study history before investing money. Even those with business school degrees fail to question the conventional wisdom, and fall prey to the above myths. The fund managers I’ve met, who outperform the market, do not. They are lateral thinkers.

(Many of them are conspiracy theorists as well, but that is a separate story, for another article.)

Based on my limited experience, it is best to read widely and diversify assets. Get opinions from multiple financial advisors and market analysts. Do your own research. I have made too many mistakes from listening to dilettantes, and I hope to spare you my errors.