“Save enough for a mortgage down payment,” your Boomer aunt tells you.

“Real estate is about time IN the market, not timing the market,” your realtor says.

“House prices always go up, so take on a home equity loan,” urges your financial advisor.

Real estate investing has more misconceptions than any other form of investing. In this article, I set the record straight.

I can only describe my own experience, based on my own mistakes in real estate. I have owned, sold, and rented out various kinds of property: condos, single-family dwellings, farmland, etc. This is not financial or investing advice. Talk to your financial advisor, do not listen to a random internet anon.

The three myths of real estate are:

House prices always go up.

Rental income is passive income.

It is always better to own than to rent.

I am sure there are more, but let us proceed to debunk these lies.

(If you enjoy my work, be sure to subscribe, and if you want to support me, consider becoming a paid subscriber.)

Myth 1: House Prices Always Go Up

On the surface, this claim is easy to disprove. One need only look at the 2008 housing market crash, which affected many OECD countries.

As the above chart shows, those who purchased property in 2007 had a rude awakening in 2008. I know of people who went bankrupt after over-borrowing with mortgages and home equity credit. It is thus false that housing prices always rise.

However, there is a sophisticated version of this claim: real estate goes up over the long term.

Based on housing data for Canada, the U.S., and Australia, this may seem true. Despite occasional crashes which last for a few years, property prices trend upwards. Therefore, say the normies, buying real estate will always net a positive return over decades.

Yet based on history, this notion falls apart. In extreme cases like the Black Death, which killed one-third of Europe’s population, real estate values fall and stay low for decades. However, even in otherwise stable countries, house prices can remain depressed for a long time.

Greece is a moderately wealthy European Union country, and yet its housing prices have been stagnant for over two decades. As the below chart shows, if you bought Greek property in 2000, then its value would be pretty much the same today in inflation-adjusted terms (blue line). If you had bought in 2007, then you would actually be poorer today.

When looking across Europe, we see similar trends in Italy, Spain, and Cyprus. Even Finland is lacklustre. Within the United States, buying a house in Flint, Michigan, in the 1990s would seem foolish. Purchasing property in these locations is, on average, a bad investment.

I suspect that property everywhere will soon endure a long-term decline. The past eighty years or so is a historical anomaly; higher house prices coincided with the Baby Boom and the proliferation of mortgages. Prior to the 1940s, people built houses over several years without taking on debt. Multi-generational homes were common. Now, we are approaching the end of a decades-long debt bubble, and population growth will turn negative.

Of course, even if house prices go down, you can always rent your house out, right?

Myth 2: Rental Income Is Passive Income

Barring a few exceptions, there is no such thing as passive income. Profitable investments require time, effort, and an appetite for risk. Rental income is no different; maintenance and repairs are ever-present, and you could land a bad tenant.

When renting a house out, you should track expenses and set money aside for repairs. Tenants will inundate you with requests to fix leaky taps, flaky paint, and worn-out shingles. To plan for this, you need to set aside 1 percent or more of the house’s market value per year. Add to this taxes and insurance, and you could pay $15,000 or more in expenses for a $2,000 per month rental property.

You could even lose money, as Canadians are quickly finding out (see below Tweet). And no, you cannot just increase rents whenever you want to; contracts are negotiated for a specific length of time. In some jurisdictions, rental increases are capped by law. Regardless, too high a rent will scare off prospective tenants.

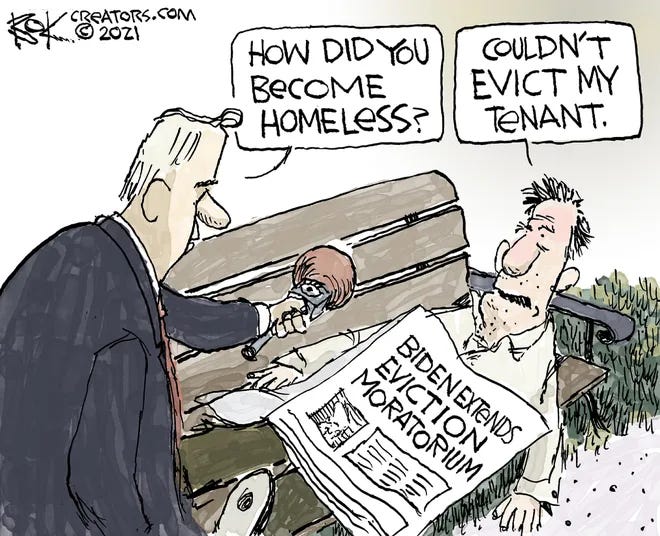

In the worst-case scenario, you end up with a tenant who damages your property and refuses to pay his monthly rent. Evicting such a tenant can be costly, and this process can take months or years. In the mean time, you still have to pay mortgage, insurance, and taxes.

In Ottawa, a landlady faces homelessness because of a non-paying tenant who refuses to leave. As the article describing her predicament says,

Small landlords — those who typically own just one or two rental units — can become homeless when a tenant refuses to pay rent and leave a space the landlord needs for their own accommodations.

A landlord who finances his purchase with a mortgage, and lacks a tenant to pay rent, will soon have the bank breathing down his throat.

Still, at least you own the house, right?

Myth 3: It Is Better To Own Than To Rent

The prior discussion suggests that it can be bad to own a house. House prices can fall, repairs and taxes can be burdensome, and tenants may be troublesome. In some cases, it is even better to rent a house than to own one, especially when there are higher returns in alternate investments.

The below chart shows that it is often cheaper to rent than to own — which means extra money in your pocket. That extra cash can be used to buy stocks, which have historically yielded higher returns than real estate. Alternately, the extra savings can be used to purchase Bitcoin, which has returned even more than stocks.

A renter also does not need to worry about repairs, maintenance, insurance, and property taxes. The landlord might increase the rent, but as long as the rental market is competitive, this is not a major issue.

There is also more flexibility to renting than buying. If you switch jobs frequently, seeking increasingly higher pay in different cities, then renting is clearly a better option than being tied down to a single property. You also will not need to deal with realtor fees and transaction costs from selling a house.

Conclusion

Buying a house is the biggest investment most people make, and yet we are inundated with myths about housing. I hope I have cleared some misconceptions, though I caution that my analysis is based on personal experience. Your own outcomes may vary.

Experienced property investors can make money in any market, through various schemes (long-term rentals vs. short-term rentals, flipping, discounted notes, REITs, etc.), but most investors should speak with an impartial advisor before purchasing real estate. Buying an $800,000 house, only to have it lose value while your tenants refuse to pay rent, is a nightmare that happens all too frequently.

If I had $1 million right now to spend on real estate, I would first put the money into a 1-year Treasury which pays 5 percent yield. Then I would wait for a year, hoping that house prices crash. After that happens, I would swoop in with my cash, and buy homes at a bargain. If prices remain high, then I would continue to invest in Treasuries, hoping that the Federal Reserve keeps rates elevated.

Ultimately, the biggest risk to real estate, in my view, is that the government will seize your home in a bid to stop “climate change,” or some other such nonsense. Indeed, the World Economic Forum has touted the idea that “you will own nothing, and you will be happy.” In the end, it is advisable to diversify your portfolio beyond just real estate, to prevent these risks.

And after that? Trust in God.

These myths are certainly just that, myths. I once had a tenant tell me that the kitchen sink was clogged, I asked if she put anything down the drain that should not be there. I was told “no, but sometimes I wash my hair in the sink.” I responded “you know the bathroom has a shower?” Tenants will never let you down with dumb stuff they do to/in your property. 100% make sure you have many thousands of dollars saved for repairs because expensive things (Hvac, water heater, etc) will absolutely break due to improper use.

Finally, I concur with the $1MM into treasuries. If/when the market pukes you could buy longer dated treasuries with part of the money and use the interest coupon to offset a future mortgage payment (or fund those pesky repairs).

Really enjoyed this honest take - thank you!